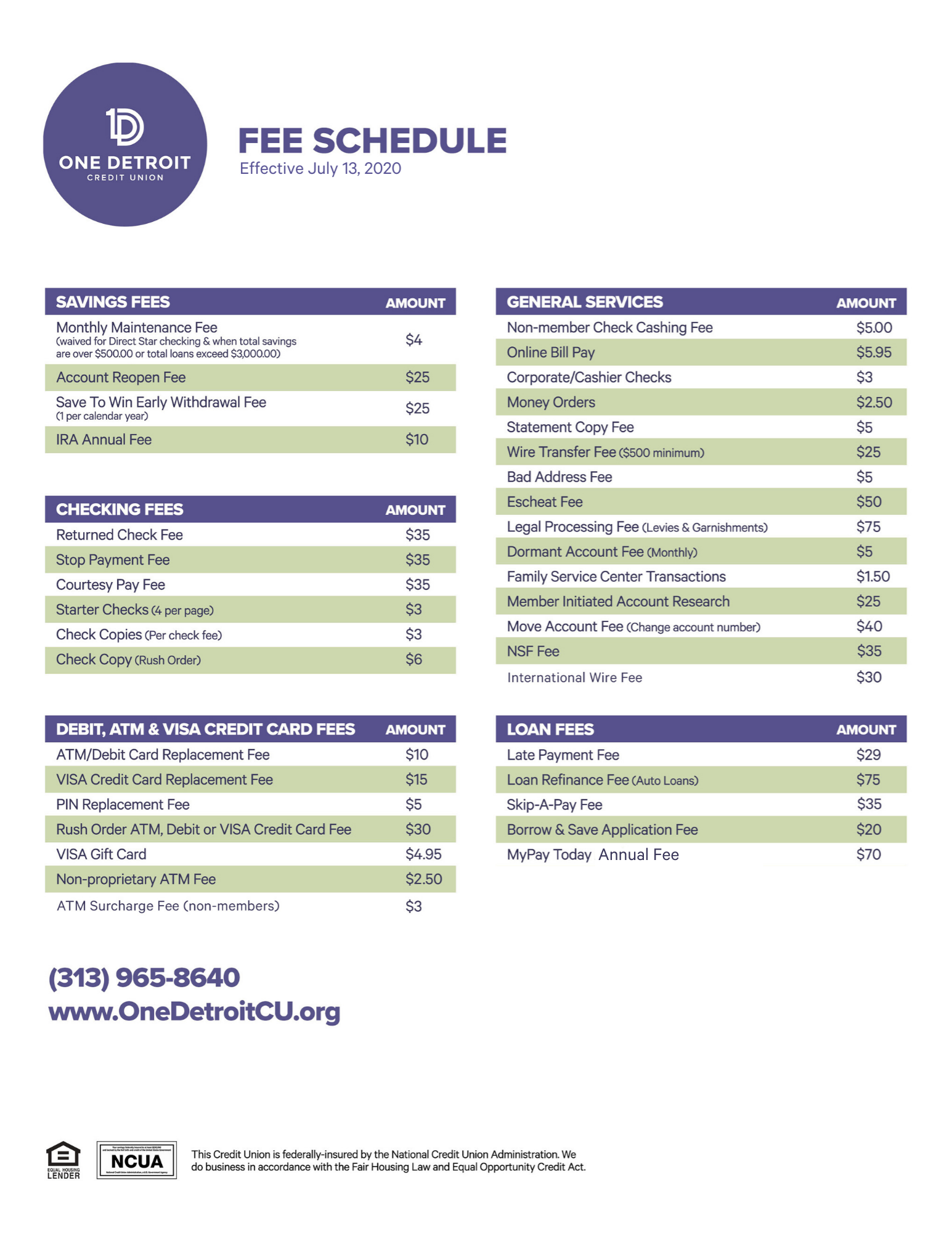

Fee Schedule

New Fees Effective July 13, 2020

One Detroit Credit Union offers competitive savings and loan rates as well as a wide variety of services. Miscellaneous fees and charges are necessary to offset increasing operational costs. Maintenance fees can be easily avoided by supporting your Credit Union with your savings and financing needs. Transaction fees can be avoided by using the One Detroit branches either through the mail, www.onedetroitcu.org, in person, or by using Tel-A-Phone Teller.

Our maintenance fees are determined by the overall savings/loan relationship of the member with the Credit Union. Overall savings encompasses funds on deposit in the Share Savings, Share Draft (Checking), Club Magic, Money Market, IRA, and Certificates of Deposit. Note: New members have a three month grace period to build savings up to desired balance.